hugo insurance : The future of car insurance

hugo insurance : The future of car insurance

Hugo Insurance build cutting edge technology that makes insurance affordable. Working to make financial stability achievable for every American. Allow drivers to pause or restart coverage at any time.

Hugo Insurance Launching

Hugo , officially launched in January 2021, offers flexible pay-per-mile insurance and unlimited policies in 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas.

Car INSURANCE POLICY

- Exact policy offerings vary by location. And while Hugo’s rates can vary significantly depending on the state, policy type you choose, and other factors like your driving history, according to Insurify data, Hugo’s average cost for a basic (liability-only) policy is $41 per month, and $75 per month for a full-coverage policy.

- Hugo Flex policies allow drivers to pause or restart coverage at any time without a fee, and you can buy coverage for as little as three days at a time. Instead of a monthly quote, Hugo calculates how much you’ll pay for a single day of car insurance and how much you can save by turning coverage off on days you don’t drive.

Hugo Car Insurance: Driving with Confidence

Car insurance is a necessity for every responsible driver. In a market flooded with options, choosing the right provider can be overwhelming.

Enter Hugo Car, a company that stands out from the crowd with its commitment to customer satisfaction and innovative solutions.

Hugo Car Insurance: Driving with Confidence

Car insurance is a necessity for every responsible driver. In a market flooded with options, choosing the right provider can be overwhelming. Enter Hugo , a company that stands out from the crowd with its commitment to customer satisfaction and innovative solutions.

Understanding Hugo Car Insurance Policies

When it comes to car insurance, one size does not fit all. Hugo offers a range of policies, including comprehensive coverage that protects against various risks, liability coverage for third-party damages, and additional options for extra peace of mind.

Factors Influencing Car Insurance Premiums

Your driving history, the type of vehicle you own, and your location all play a role in determining your insurance premiums. Hugo takes these factors into account, providing personalized quotes that reflect your unique circumstances.

The Process of Obtaining Hugo Car Insurance

Gone are the days of lengthy paperwork and tedious processes. Hugo makes obtaining car insurance a breeze with online quotes and applications. The customization options allow you to tailor your policy to suit your specific needs, and their customer support ensures you’re never alone in the process.

Benefits of Choosing Hugo

Competitive rates, quick claims processing, and high customer satisfaction are the hallmarks of Hugo . They understand that affordability, efficiency, and customer happiness are key components of a successful insurance experience.

Tips for Lowering Car Insurance Premiums

Hugo not only provides excellent coverage but also empowers you to lower your premiums. Safe driving habits, bundling policies, and taking advantage of discounts are just a few ways you can make the most of your Hugo.

Customer Testimonials

Don’t just take our word for it—hear from real customers who have experienced the benefits of Hugo firsthand. Their stories highlight the reliability and trustworthiness that define the company.

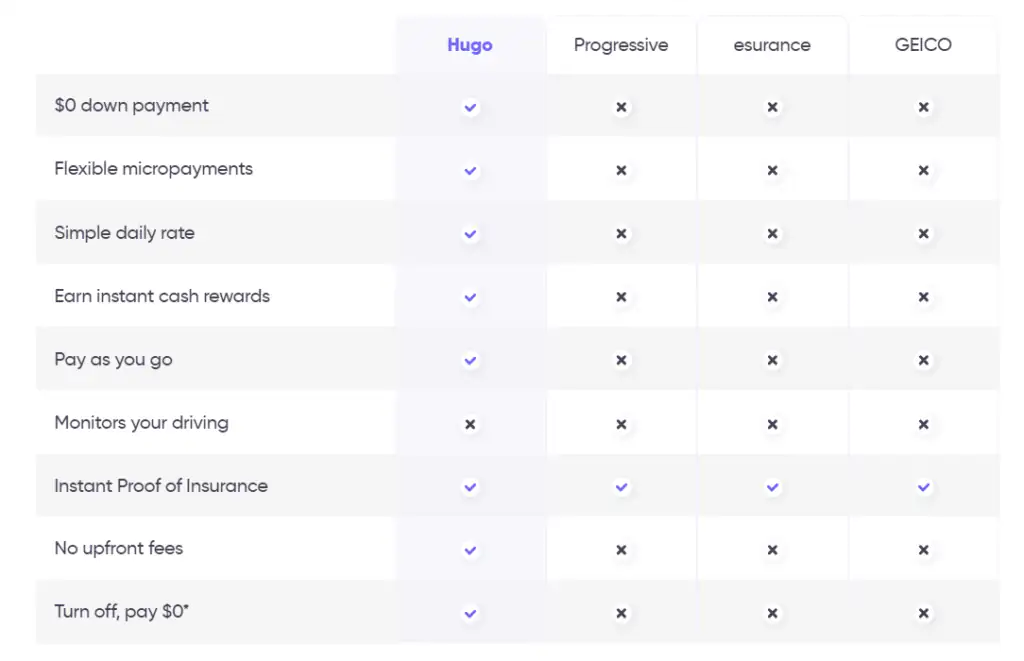

Comparing Hugo Car with Competitors

In a competitive market, Hugo stands tall. By comparing it with competitors, we uncover the unique features, cost-effectiveness, and overall value that set Hugo apart.

Addressing Common Misconceptions About Car Insurance

Car insurance myths can cloud our judgment. In this section, we debunk common misconceptions, providing clarity on what car insurance truly entails and why Hugo is a reliable choice.

Top 10 Best Car Insurance Companies Of September 2023

The Future of Car Insurance Industry

As technology advances, so does the car insurance industry. Discover how Hugo is at the forefront of these changes, adapting to evolving customer needs and shaping the future of insurance.

Hugo Car in the Media

Press coverage and reviews provide insights into the public’s perception of Hugo . Explore how the media views the company and what key points they highlight.

Navigating the Hugo Car Website

A user-friendly website is crucial for a positive customer experience. Learn how easy it is to access policy information and manage your account through Hugo’s intuitive interface.

Why Hugo Car Stands Out

Hugo’s commitment to customer satisfaction and innovative solutions sets it apart. Dive into the reasons why customers choose Hugo for their car insurance needs.

Looking Ahead: Trends in Car Insurance

What does the future hold for car insurance, and how is Hugo positioned in this changing landscape? Explore predictions for the industry and Hugo’s role in shaping tomorrow’s insurance experience.

Conclusion

Choosing the right car insurance is a decision that impacts your safety and peace of mind. With Hugo, you’re not just getting coverage; you’re gaining a partner in your journey on the road. Explore the possibilities, and drive with confidence.

FAQs (Frequently Asked Questions)

- Is Hugo Car Insurance available nationwide?

- Yes, Hugo Car Insurance provides coverage nationwide, ensuring you’re protected wherever you go.

- How quickly can I get a quote from Hugo?

- You can receive a personalized quote from Hugo Car Insurance within minutes by completing their online application.

- What discounts does Hugo offer to policyholders?

- Hugo provides various discounts, including safe driver discounts, bundling discounts, and special promotions.

- How does Hugo handle claims processing?

- Hugo is known for its quick and efficient claims processing, ensuring that you get the support you need when you need it.

- Can I manage my Hugo Car Insurance policy online?

- Absolutely! Hugo offers an easy-to-navigate website that allows you to manage your policy, access documents, and make changes seamlessly.