investment fintechzoom : Online Loans Fintechzoom

Investment fintechzoom : Online Loans Fintechzoom

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s a medical emergency, home repair, or a sudden investment opportunity, having access to quick and reliable financial assistance is crucial. This is where Online Loans Fintechzoom steps in, offering a lifeline to individuals seeking financial solutions. In this article, we will delve into the world of Online Loans Fintechzoom, exploring how this fintech platform is revolutionizing the lending industry.

Understanding the Fintech Revolution

The Emergence of Online Lending

The advent of technology has transformed various aspects of our lives, including the way we borrow and manage money. Online lending platforms like Fintechzoom have gained immense popularity in recent years, disrupting traditional banking systems.

What Sets Online Loans Fintechzoom

Online Loans Fintechzoom distinguishes itself from traditional lenders in several ways:

1. Speed and Convenience

Online Loans Fintechzoom offers a hassle-free application process that can be completed from the comfort of your home. Unlike traditional banks, there are no long queues or extensive paperwork involved.

2. Accessibility for All

This platform welcomes borrowers from all walks of life, including those with less-than-perfect credit scores. Online Loans Fintechzoom believes in financial inclusivity.

3. Competitive Interest Rates

Fintechzoom strives to provide competitive interest rates, ensuring that borrowers can access funds without incurring exorbitant costs.

What is FintechZoom?

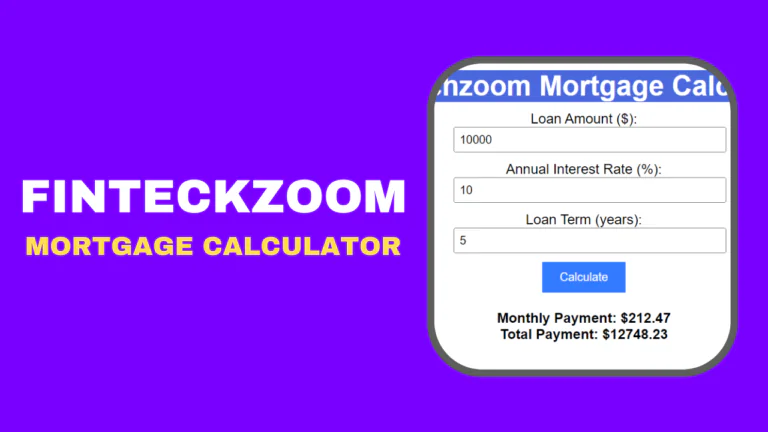

Consumers can examine a variety of online lending options on the website Fintechzoom. A loan calculator on Fintechzoom allows users to calculate their monthly payments and overall interest costs.

Fintechzoom is a helpful resource for contrasting various online lending options. It’s important to remember that Fintechzoom is not a lender, though. The website just provides information about different lenders. The lender that is best for you must be chosen by you.

The Application Process Made Simple

Getting an online loan through Fintechzoom is straightforward:

Registration

Create an account on the Fintechzoom platform by providing your basic information.

Loan Application

Fill out the loan application form, specifying the loan amount and duration.

Verification

Fintechzoom’s advanced algorithms quickly assess your eligibility, making instant decisions.

Approval and Disbursement

Once approved, your funds are disbursed directly into your bank account. The entire process can be completed within minutes.

Benefits of Choosing Online Loans Fintechzoom

1. Rapid Access to Funds

Emergencies don’t wait, and neither does Fintechzoom. With quick approvals and same-day disbursements, you can tackle financial crises without delay.

2. Flexible Repayment Options

Fintechzoom offers a range of repayment plans, allowing you to choose one that fits your financial situation.

3. Enhanced Financial Literacy

The platform provides valuable financial insights and resources to help borrowers make informed decisions.

4. Secure and Transparent

Online Loans Fintechzoom prioritizes data security and transparency, ensuring that your personal and financial information is protected.

Who Can Benefit from FintechZoom?

Individuals with Emergency Expenses

FintechZoom provides immediate access to finances for people who need to pay unexpected expenses, such as medical bills, auto repairs, or house crises.

Small Business Owners

Small company owners and entrepreneurs frequently need quick cash for a variety of reasons. FintechZoom provides loans to businesses , so they can take advantage of opportunities or recover from financial misfortunes.

Students

FintechZoom’s student loans act as a lifeline for students who are struggling to pay for tuition or other educational costs and keep education within their means.

How does Fintechzoom work?

You have the option to explore various online lending choices through the user-friendly Fintechzoom website. Once you’ve done that, Fintechzoom will provide you with a list of lenders that can provide loans tailored to your specific needs.

For each lender, Fintechzoom will display the following information: Online Loans FintechZoom

Interest Rate: The amount you pay for the loan will depend on the interest rate.

Fees: Fees like origination costs, late payment fees, and prepayment penalties could apply to a loan application.

Payback Terms: How long you have to make payments is outlined in the loan’s terms of repayment.

Customer Evaluations: On Fintechzoom, client reviews for each lender are displayed. By doing this, you can get a better idea of how other borrowers have interacted with the lender.

The Future of Online Lending

As technology continues to evolve, the online lending landscape is expected to expand further. Online Loans Fintechzoom is at the forefront of this evolution, committed to improving and simplifying the borrowing experience.

You Need Read This Investment FintechZoom: Revolutionizing Finance in the Digital Age

Conclusion

Online Loans Fintechzoom is a testament to the power of fintech in reshaping the financial industry. With its user-friendly platform, accessibility, and commitment to customer satisfaction, it stands as a reliable financial lifeline for modern consumers.

FAQs

Is my personal information safe with Online Loans Fintechzoom?

Yes, Online Loans Fintechzoom employs state-of-the-art security measures to protect your data.

Can I apply for a loan with a low credit score?

Absolutely! Online Loans Fintechzoom believes in financial inclusivity and welcomes borrowers with various credit backgrounds.

Are there any hidden fees or charges?

Online Loans Fintechzoom is transparent about its fees, ensuring that you know the cost of borrowing upfront.

What if I have trouble repaying my loan?

Fintechzoom offers flexible repayment options and encourages borrowers to reach out for assistance if needed.

What factors influence my eligibility for a FintechZoom personal loan?

Your credit score, income, employment history, and debt-to-income ratio all have an impact on whether you qualify for a FintechZoom personal loan.

Can I pay off my FintechZoom loan before the term ends?

Yes, a few of the loans FintechZoom offers permit early payback without incurring fees. This may lead to lower interest costs, which could lead to financial savings.