Fintechzoom Mortgage Calculator : Monthly Mortgage Payment

A mortgage is a common financial instrument that allows homeowners to purchase their property. However, understanding the precise financial implications of a mortgage can be tricky.

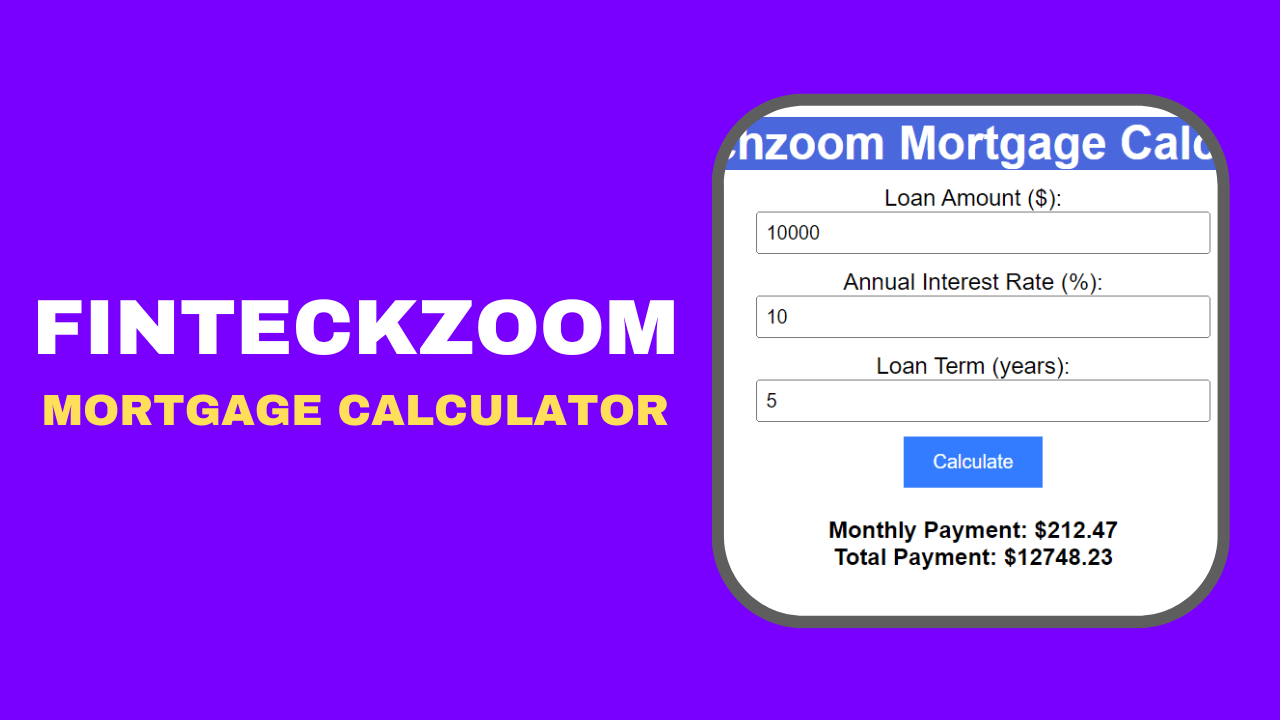

This powerful online tool lets individuals calculate their home loans quickly and accurately. With the Mortgage Calculator, you can easily determine the down payment, monthly payment, total payment, and interest rate of the loan.

No more headaches trying to understand the complex world of mortgages – FintechZoom’s Mortgage Calculator has you covered.

Fintechzoom Mortgage Calculator

How Does a Mortgage Work?

When it comes to purchasing a home, many people rely on mortgages to finance their dream abode. But how does a mortgage actually work? In this comprehensive guide, we will break down the intricacies of mortgages, shedding light on the process, types of mortgages, and important considerations for prospective homebuyers.

You Need Read This Online Loans Fintechzoom

Understanding Fintechzoom Mortgage

A mortgage is essentially a loan that helps you buy a home. It’s a significant financial commitment that involves borrowing money from a lender to purchase a property. However, there’s more to it than just borrowing funds. Let’s delve into the finer details.

The Homebuyer’s Role

- Determining Affordability: Before diving into the homebuying process, it’s crucial to assess your financial situation. Calculate your budget, including your income, expenses, and savings.

- Choosing a Lender: Once you’re ready to buy a home, you’ll need to find a lender who can provide you with the necessary funds. Lenders can be banks, credit unions, or mortgage companies.

- Selecting a Mortgage Type: Mortgages come in various forms, including fixed-rate, adjustable-rate, and government-backed loans like FHA and VA. Understanding the differences is essential.

- Down Payment: Most mortgages require a down payment, typically a percentage of the home’s purchase price. A larger down payment often results in better loan terms.

You Need Read This Investment FintechZoom: Revolutionizing Finance in the Digital Age

The Lender’s Role

- Loan Application: After choosing a lender, you’ll need to complete a mortgage application. This involves providing detailed financial information, such as your credit score, income, and employment history.

- Credit Check: Lenders will assess your creditworthiness through a credit check. A good credit score can lead to more favorable mortgage terms.

- Underwriting: The lender’s underwriting team reviews your application, ensuring you meet their criteria. They’ll also appraise the property to determine its value.

- Approval and Terms: If your application is approved, you’ll receive a mortgage offer that outlines the loan terms, interest rate, and monthly payments.

Mortgage The Repayment Process

- Monthly Payments: Once you accept the mortgage offer, you’ll begin making monthly payments. These payments include both principal (the loan amount) and interest.

- Interest Rates: The interest rate on your mortgage can be fixed or variable. Fixed rates remain constant throughout the loan term, while variable rates can fluctuate.

- Amortization: Over time, your monthly payments will primarily go toward reducing the loan’s principal balance. This process is known as amortization.

Fintechzoom Mortgage Important Considerations

- Loan Term: Mortgages typically have loan terms of 15, 20, or 30 years. Shorter terms result in higher monthly payments but less interest paid over time.

- Closing Costs: Homebuyers are responsible for paying closing costs, which include fees for inspections, appraisals, and legal services.

- Defaulting on a Mortgage: Failing to make mortgage payments can lead to foreclosure, wherein the lender repossesses the property.

- Homeownership Responsibilities: Owning a home involves maintenance, property taxes, and homeowner’s insurance. These ongoing expenses are important to budget for.

Fintechzoom Mortgage Conclusion

In conclusion, a mortgage is a powerful financial tool that allows individuals to achieve the dream of homeownership. Understanding the intricacies of mortgages, from the homebuyer’s role to the lender’s responsibilities and the repayment process, is crucial for making informed decisions when purchasing a home.

For those considering a mortgage, it’s essential to conduct thorough research, compare loan options, and consult with financial experts to ensure a smooth homebuying experience.

Frequently Asked Questions (FAQs)

- What’s the minimum down payment required for a mortgage?

- The minimum down payment varies but is often around 3-5% of the home’s purchase price. However, a larger down payment can lead to better loan terms.

- How does my credit score affect my mortgage application?

- Your credit score plays a significant role in your mortgage application. A higher score can lead to better interest rates and loan terms.

- What’s the difference between a fixed-rate and adjustable-rate mortgage?

- A fixed-rate mortgage has a constant interest rate throughout the loan term, while an adjustable-rate mortgage’s interest rate can change over time.

- Can I refinance my mortgage to get better terms?

- Yes, you can refinance your mortgage to take advantage of lower interest rates or change your loan terms. It can potentially save you money over the life of the loan.

- What should I do if I’m struggling to make my mortgage payments?

- If you’re facing financial difficulties, it’s essential to contact your lender and explore options like loan modification or refinancing to avoid defaulting on your mortgage.